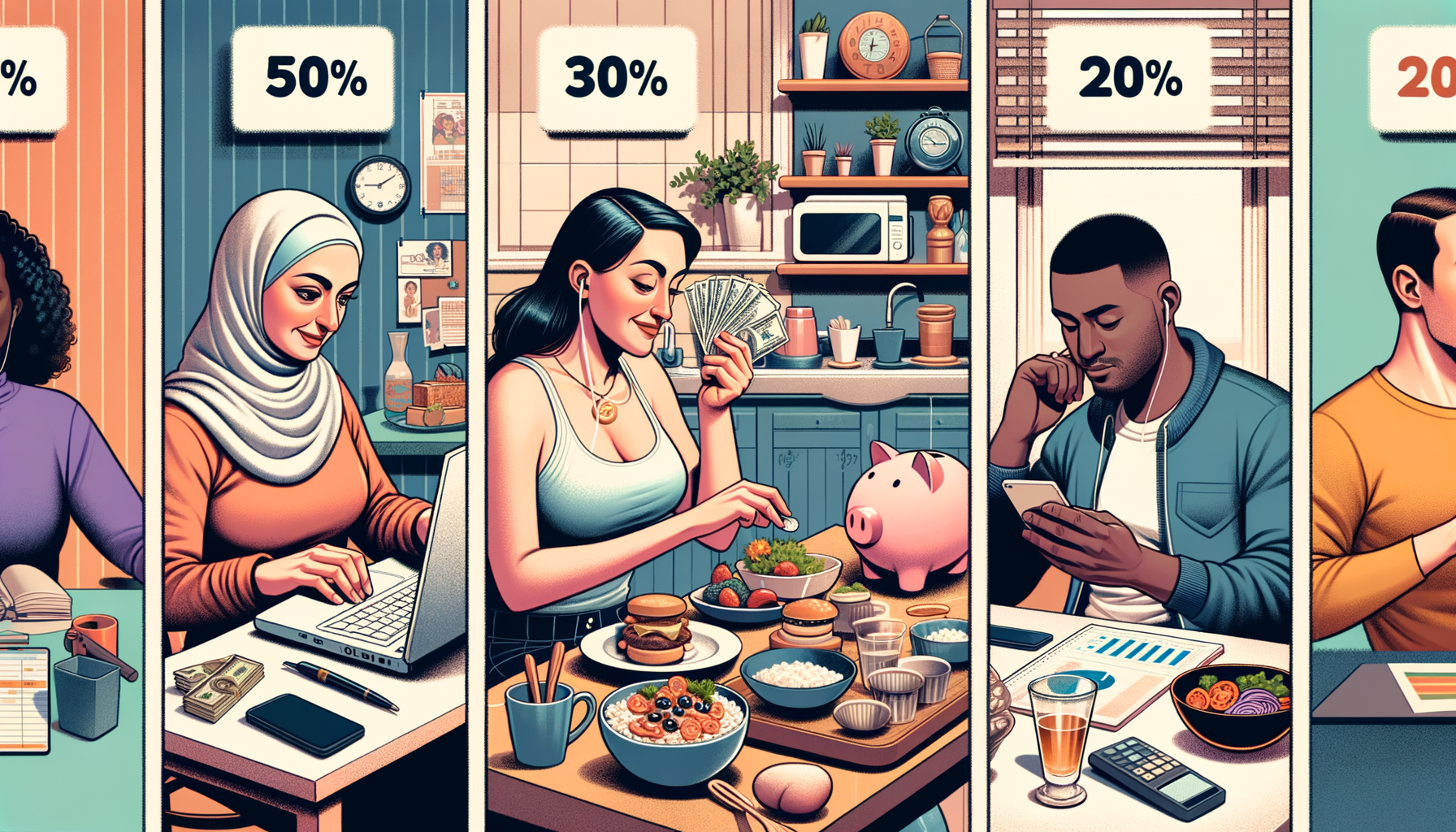

The 50/30/20 Budgeting Rule Explained

In today's fast-paced world, managing Finances efficiently is crucial. One of the most popular and straightforward budgeting methods is the 50/30/20 budgeting rule. This rule helps individuals allocate their income effectively without getting bogged down by complex financial jargon. Let’s dive into the details of the 50/30/20 budgeting rule and how it can benefit you.

What is the 50/30/20 budgeting Rule?

The 50/30/20 budgeting rule is a simple yet powerful financial strategy introduced by Elizabeth Warren, a Harvard bankruptcy expert, and her daughter, Amelia Warren Tyagi, in their book All Your Worth: The Ultimate Lifetime Money Plan. This method divides your after-tax income into three main categories:

- Needs (50%): These are essential expenses that you must pay to live and work. They include rent or mortgage payments, groceries, utilities, insurance, and transportation costs.

- Wants (30%): These expenses are not essential but enhance your lifestyle and personal satisfaction. They include dining out, entertainment, hobbies, vacations, and other leisure activities.

- savings (20%): This category is for your financial future. It includes retirement accounts, Emergency Funds, investments, debt repayments (beyond the minimum payments), and other savings goals.

How to Implement the 50/30/20 Rule

Step 1: Calculate Your After-Tax income

Your after-tax income is your total income minus any taxes and deductions such as federal, state, and local taxes, Social security, and Medicare contributions. This can be found on your paycheck stub or annual tax return.

Step 2: Allocate Your income

Once you have your after-tax income, you can allocate it according to the 50/30/20 rule:

-

Needs (50%):

-

Wants (30%):

-

savings (20%):

Step 3: Track and Adjust Your spending

It’s essential to track your expenses regularly to ensure you’re sticking to the Budget. Use budgeting apps or spreadsheets to record your spending and make adjustments if necessary. If you overspend on wants, cut back to stay within the 30% limit.

Benefits of the 50/30/20 Rule

Simplicity

The 50/30/20 budgeting rule is straightforward, making it easy to implement regardless of your financial literacy level. It eliminates the complexity of detailed budgeting categories and focuses on broad categories, making it easier to manage.

Flexibility

This rule is flexible and can be adjusted based on individual circumstances. For example, if you live in an area with high housing costs, you might allocate more than 50% for needs and adjust the other categories accordingly.

financial discipline

By adhering to the 50/30/20 rule, you instill financial discipline. It encourages saving and prevents overspending on non-essentials, helping you build a strong financial foundation.

Long-Term financial security

By prioritizing savings, the 50/30/20 rule ensures you are consistently setting aside money for the future. This habit helps build an emergency fund, save for retirement, and achieve other long-term financial goals.

Reduced financial stress

Having a clear plan for your money reduces financial stress. Knowing that your essential expenses are covered, you have room to enjoy life, and you are saving for the future brings peace of mind.

TIPS for Success with the 50/30/20 Rule

-

automate your savings:

Set up automatic transfers to your savings or retirement accounts. This ensures you consistently save 20% of your income without temptation. -

Review and Adjust Regularly:

Life circumstances change, so it’s essential to review your Budget periodically. Update your allocations if you get a raise or have a significant change in expenses. -

Be Realistic:

Ensure your category allocations are realistic and reflect your lifestyle. If you find it challenging to stick to the limits, reassess and adjust accordingly. -

Seek Professional Advice:

If you're unsure about your budgeting strategy, consider consulting with a Financial advisor. They can provide personalized advice and help you optimize your Finances.

Conclusion

The 50/30/20 budgeting rule is a powerful tool that simplifies financial management and promotes financial stability. By categorizing your income into needs, wants, and savings, you can take control of your Finances, reduce stress, and secure a prosperous future. Start implementing this rule today and experience the peace of mind that comes with a well-organized financial plan.