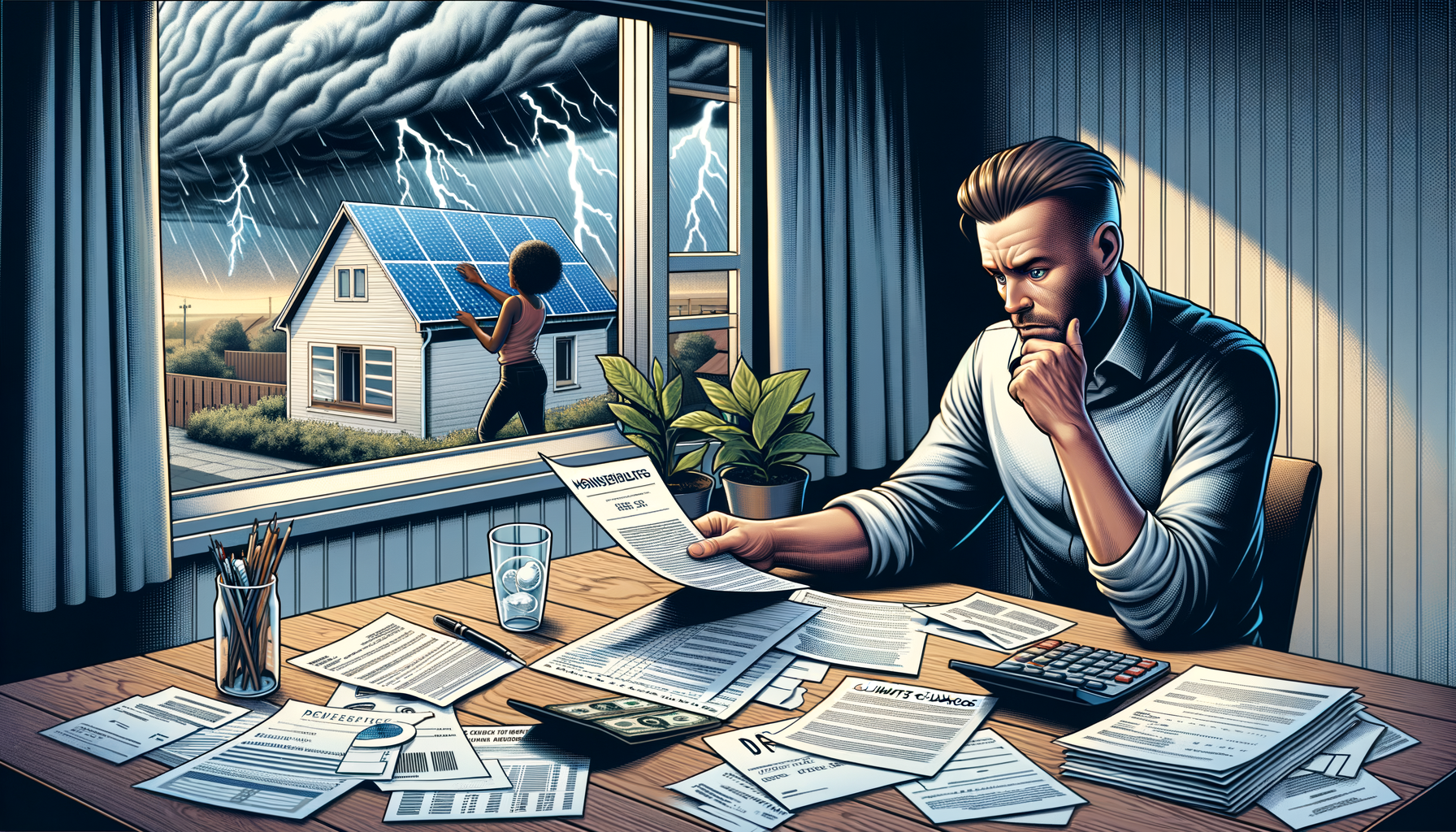

The Financial Impact of Climate Change on Personal Finance

climate change is not just an environmental issue; it's a financial one too. As the effects of climate change increasingly impact our world, they also pose significant risks to personal finance. Understanding the financial implications of climate change can help you better prepare and manage your Finances. In this article, we'll explore how climate change affects personal finance, and what you can do to mitigate these risks.

Rising insurance Costs

One of the most immediate financial impacts of climate change is the rising cost of insurance. Extreme weather events, such as hurricanes, floods, and wildfires, have become more frequent and severe. This increase in natural disasters has led to greater claims on insurance policies, prompting insurers to hike premiums. Homeowners, renters, and even auto insurance policyholders are feeling the pinch.

For instance, in regions prone to flooding, insurance companies are adjusting their risk models and raising premiums. Homeowners who previously paid manageable premiums may find themselves facing steep increases. This scenario not only affects monthly budgets but also the overall Affordability of homeownership.

Housing Market Vulnerability

climate change can also destabilize the housing market. Properties in areas vulnerable to sea-level rise, hurricanes, or wildfires may decrease in value, making them harder to sell. Potential buyers may be deterred by the higher insurance premiums and the looming threat of property damage.

Real estate investments are not immune either. Coastal properties and other high-risk areas may become less attractive, leading to decreased property values and potential financial losses for investors.

Impact on Jobs and income

industries dependent on natural resources, such as agriculture, fishing, and tourism, are particularly vulnerable to climate change. As weather patterns shift and extreme weather events become more common, these industries may experience reduced productivity, leading to job losses and decreased income for workers.

For instance, prolonged droughts can devastate crops, affecting farmers' incomes and increasing food prices. Similarly, rising sea temperatures can impact fish populations, affecting the livelihood of fishermen.

Increased Living Costs

climate change can also lead to increased living costs. For instance, higher temperatures may result in increased energy consumption as more people rely on air conditioning. This increased demand can drive up energy prices, impacting your monthly utility bills.

Additionally, disruptions in the supply chain caused by extreme weather events can lead to higher prices for goods and services. For example, hurricanes can disrupt transportation routes and damage infrastructure, leading to increased costs for shipping and, subsequently, higher prices for consumers.

Investment risks

climate change poses significant risks to Investment portfolios. Companies across various sectors, from oil and gas to manufacturing, are susceptible to the impacts of climate change and the transition to a low-carbon economy. For example, regulatory changes aimed at reducing carbon emissions can impact the profitability of fossil fuel companies.

investors should consider the environmental, social, and governance (ESG) criteria when making Investment decisions. ESG investing allows you to invest in companies that prioritize sustainability and are better equipped to handle the challenges posed by climate change. By aligning your investments with companies that have strong ESG practices, you can mitigate risks and potentially improve your portfolio's long-term Performance.

How to Mitigate the Financial risks of climate change

-

Review and Adjust insurance Coverage: Regularly review your insurance policies to ensure you have adequate coverage. Consider adding coverage for climate-related risks, such as flood insurance, even if you don't live in a high-risk area.

-

Diversify investments: Diversifying your Investment portfolio can help mitigate risks. Consider including ESG investments or green bonds, which focus on sustainability and Environmental Impact.

-

build an emergency fund: Having a robust emergency fund can provide financial security in the event of job loss or unexpected expenses due to climate-related events.

-

Invest in Energy Efficiency: Making energy-efficient upgrades to your home can reduce energy consumption and lower utility bills, providing long-term cost savings.

-

Stay Informed: Keep abreast of climate change developments and policy changes that may impact your Finances. Staying informed will allow you to make proactive Financial Decisions.

Conclusion

The financial impact of climate change on personal finance is profound and multifaceted. By understanding the risks and taking proactive steps to mitigate them, you can protect your financial well-being and build a more resilient future. Review your insurance policies, Diversify your investments, and stay informed about climate change developments to navigate this challenging landscape effectively.