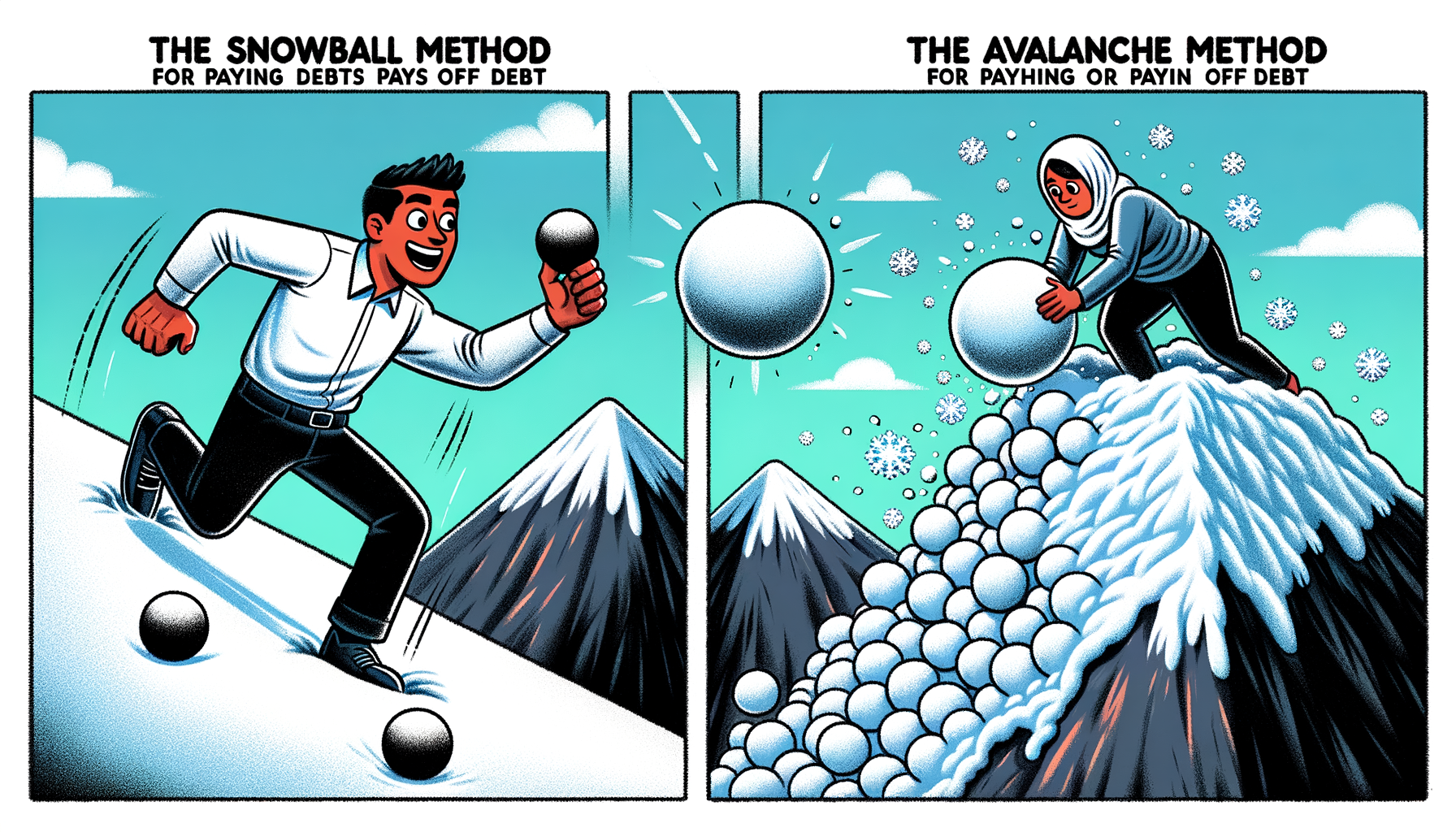

The Snowball Method vs. The Avalanche Method for Paying Off Debt

debt can be a daunting financial burden, but the right repayment strategy can make a significant difference in how quickly and efficiently you can become debt-free. Two of the most popular methods for paying off debt are the Snowball Method and the Avalanche Method. Each approach has its unique Benefits and caters to different financial personalities. In this article, we will dive deep into the intricacies of both methods to help you decide which one is best for you.

Understanding the Snowball Method

The Snowball Method, popularized by financial expert Dave Ramsey, focuses on paying off your smallest debts first regardless of their interest rates. Here's how it works:

- List Your debts: Write down all your debts in order from the smallest balance to the largest.

- Minimum Payments: Continue to make minimum payments on all your debts.

- Attack the Smallest debt: Use any extra money you have to pay off the smallest debt first.

- Move On: Once the smallest debt is paid off, take the money you were using to pay it off and apply it to the next smallest debt.

Advantages of the Snowball Method

- Psychological Boost: Paying off smaller debts quickly provides a sense of accomplishment and motivates you to tackle larger debts.

- Easy to Implement: The simplicity of focusing on the smallest debt makes this method easy to follow.

Disadvantages of the Snowball Method

- Potentially Higher Cost: By focusing only on the smallest amount, you might end up paying more in interest over time.

Understanding the Avalanche Method

The Avalanche Method prioritizes paying off debts with the highest interest rates first. Here's how this approach works:

- List Your debts: Write down all your debts in order of the highest interest rate to the lowest.

- Minimum Payments: Continue to make minimum payments on all your debts.

- Focus on High-Interest debt: Use any extra money to pay down the debt with the highest interest rate first.

- Move On: Once the highest interest debt is paid off, redirect those payments to the next highest interest debt.

Advantages of the Avalanche Method

- Interest savings: You end up paying less in interest over the long term, making this method more cost-effective.

- Faster Payoff: By targeting high-interest debts, you can potentially pay off your debt more quickly.

Disadvantages of the Avalanche Method

- Less Immediate Reward: Paying off high-interest debt can take longer, which might discourage those who need frequent wins to stay motivated.

- Complexity: This method requires more tracking and can be less straightforward than the Snowball Method.

Choosing the Right Method for You

Choosing between the Snowball Method and the Avalanche Method largely depends on your personal financial situation and psychological preferences.

- Motivation: If you need quick wins to stay motivated, the Snowball Method might be the better choice for you.

- Cost Efficiency: If paying the least amount of interest is your primary goal, then the Avalanche Method is a more suitable option.

- debt Amounts: If the amounts of your debts vary greatly, the psychological boost from the Snowball Method can be immensely helpful.

Statistically, those who stick with a debt repayment plan, regardless of the method, fare much better in the long run. The key is to understand your financial habits and choose the method that will keep you committed to becoming debt-free.

Conclusion

Both the Snowball Method and the Avalanche Method have their merits and drawbacks. Your choice will depend on what motivates you and how you handle financial stress. Whether you choose the Snowball Method for its quick wins or the Avalanche Method for its interest savings, the important thing is to start paying off your debts systematically and stay committed to your plan.

By knowing the strengths and weaknesses of each method, you can take a significant step towards financial freedom. Choose the strategy that resonates with you and start your journey towards a debt-free life today.